Long Put Calendar Spread

Long Put Calendar Spread - Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same.

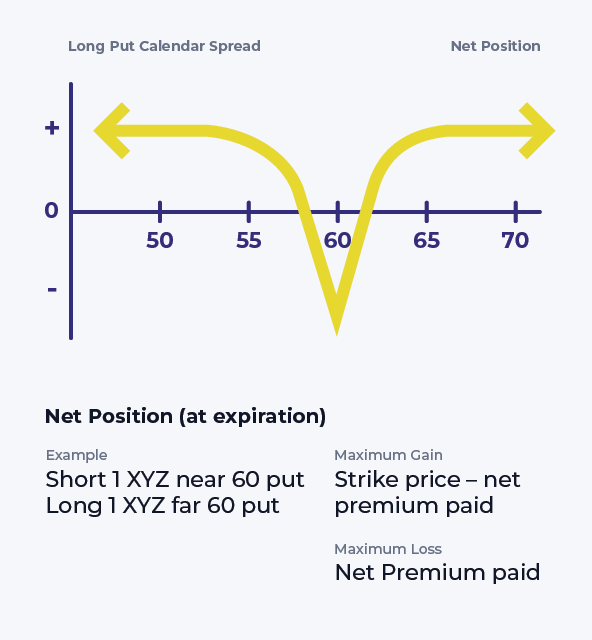

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a.

Long Calendar Spread with Puts Strategy With Example

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long put calendar spread involves buying and selling put options for the same.

The Long Calendar Spread Explained Options Cafe

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price.

Calendar Spread Option Strategy 2024 Easy to Use Calendar App 2024

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same.

Calendar Spread What is a Calendar Spread Option? tastytrade

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a.

Long Calendar Spreads Unofficed

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price.

Bearish Put Calendar Spread Option Strategy Guide

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a.

Glossary Archive Tackle Trading

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price.

Calendar Put Spread Options Edge

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same.

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same.

Web A Long Put Calendar Spread Involves Buying And Selling Put Options For The Same Underlying Security At The Same.

Web a long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying.